|

The Energy Efficiency Financial Institutions Group, established by the European Commission Directorate-General for Energy and the United Nations Environment Program Finance Initiative released an underwriting toolkit authored in part by Cycle7.

4 Comments

Sean Neill Reposted from the Urban Green Council, July 12, 2017WHAT’S A GREEN JOB?“Energy efficiency retrofits…is that like solar panels? And light bulbs?” Questions like these are familiar to every building owner or developer who has sought financing to replace outdated energy systems in old buildings. And they aren’t just naïve questions from the uninitiated. Lenders genuinely interested in new business lines and the environment often direct their senior staff to explore energy efficiency. They attend, speak at and even host high-profile conferences and seminars. But despite compelling presentations about climate change and the dramatic overuse of energy in our aging building stock, many lenders still find themselves uncertain as to what an energy efficiency project is and what “energy efficiency finance” is.

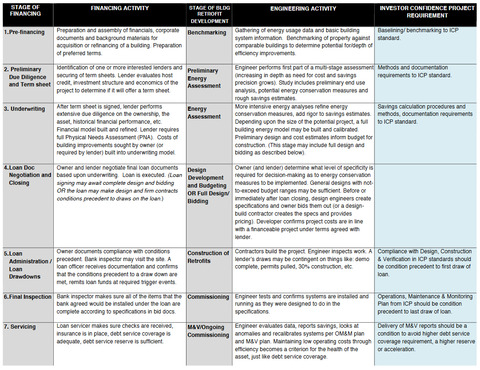

And it’s probably our fault. That is, blame may lie with the policymakers and advocates who have promoted energy efficiency as a distinct industry, a distinct engineering practice, a distinct lending niche and even a distinct legal specialty. Government officials like to talk about “green jobs” as though they were different from other jobs. But they are not. In an energy efficiency project, the firms that install lighting will modify the specifications for work they already do and use different, better lighting and standards. The firms that design and install chillers, controls systems and boilers do the same work, but instead use better designs, standards and systems. It is not as sexy as the idea of a new green profession, but to address the looming environmental crisis, all jobs must become “green jobs.” LENDING FOR SUSTAINABILITY The same is true of lenders. All lenders can and should be green lenders, and they can do so by making minor adjustments to the lending they already do. Lenders need only modify their approach to the origination, underwriting and servicing of loans they already make. Countless retrofit projects have crashed on the complex legal and financial shoals of prohibitive mortgage covenants. However, lenders can set aside the structural challenges of lending for improvements in the buildings where there is another, pre-existing mortgage lender by simply focusing on the real properties where they are the senior lender, or will be post-acquisition. THE LENDING PROCESS Whether for construction or refinance, real property lending follows fairly standard procedures. A real estate company meets with lenders, presents a building (or buildings) for acquisition or refinance and solicits term sheets. It negotiates with the lenders for optimal terms and executes a term sheet, at which point underwriting begins. The due diligence process invariably includes a physical condition survey, and owners typically pursue (and lenders may require) physical improvements to the property as part of the (re)financing. These improvements often include energy-related infrastructure and could readily include more of it. The parties agree to final terms based on the results of underwriting and due diligence. Then lawyers draw up loan documents that tie disbursements to completion of various milestones, including physical improvements. The lender’s servicer tracks indicators of financial health, such as debt service coverage and the size of reserves. GREENER PROCEDURES Each of these steps can turn current lending practices into “green lending” with modest adjustments, as seen in the chart below. The point is to demonstrate that the processes involved in green lending are those that lenders already do, every day, in astronomical volumes. What’s required is not a major overhaul of decades-old underwriting practices, only a modest set of tweaks that would make all real property lending into energy efficiency lending. And the standards to be applied have already been created, through an effort called the Investor Confidence Project (ICP). The ICP drew on many of the world’s leading energy engineers and practitioners to compile and streamline the best energy efficiency practices available. They then tied them together into a seamless process that matches the loan cycle, from origination through servicing. Government could contribute in significant ways by requiring some of these analytics at acquisition or refinance and, say, reducing mortgage taxes for those owners who implement improvements. By thinking of energy efficiency as a specialty worthy of its own professional practice, loan product or borrowing window, we have missed the big opportunity. But we still have the chance to make modest changes that can turn the work we already do every day into a contribution to the health of the planet. STEP-BY-STEP: MAKING ALL LENDING GREEN Click to enlarge. |

Sean O'NeillThoughts, articles and other readings. |

RSS Feed

RSS Feed